For pilgrims planning Umrah through Umrah Travel Agency Bloomsbury, travel insurance is vital, offering financial protection and peace of mind in unfamiliar environments. When choosing a plan, consider coverage scope, healthcare provider networks, and exclusions like pre-existing conditions. Managed care plans offer lower costs through network partnerships, while indirectly purchased plans provide greater flexibility. Ensure your policy covers emergency evacuations, hospitalization, medication, and relevant check-ups in Saudi Arabia. Understand the claims process by filing digital claims with essential documents to track progress easily. Maximize benefits by reviewing policies, keeping medical records, and promptly informing insurers of changes or health issues for a worry-free Umrah experience.

“Embark on your Umrah journey with peace of mind by understanding the intricacies of health insurance. This comprehensive guide, tailored for travelers like you through Bloomsbury’s travel agency, delves into essential aspects of coverage. We explore why travel insurance is vital, dissect various health plans, and provide a step-by-step guide to selecting suitable coverage. Additionally, learn about the claims process and discover top tips to optimize your benefits. Ensure a smooth and secure Umrah experience with these insightful tips.”

- Understanding Health Insurance: A Comprehensive Guide

- Why Travel Insurance is Essential for Umrah Trips

- Deciphering the Different Types of Plans Available

- How to Choose the Right Coverage for Your Journey

- Claims Process and What to Expect

- Top Tips for Maximizing Your Health Insurance Benefits

Understanding Health Insurance: A Comprehensive Guide

Understanding health insurance is essential, especially for those planning a trip with a Umrah Travel Agency Bloomsbury. It’s more than just a policy; it’s a safety net that provides financial protection and peace of mind when facing unexpected medical emergencies abroad. Health insurance coverage typically includes hospital stays, doctor visits, prescription medications, and sometimes even emergency evacuation services.

When choosing a plan, consider factors like the scope of coverage, network of healthcare providers, and exclusions. For instance, some policies might not cover pre-existing conditions or require you to seek approval for specific treatments. Ensuring your health insurance aligns with your travel needs, including any specialized care required during your Umrah journey, is key to a smooth and healthy experience.

Why Travel Insurance is Essential for Umrah Trips

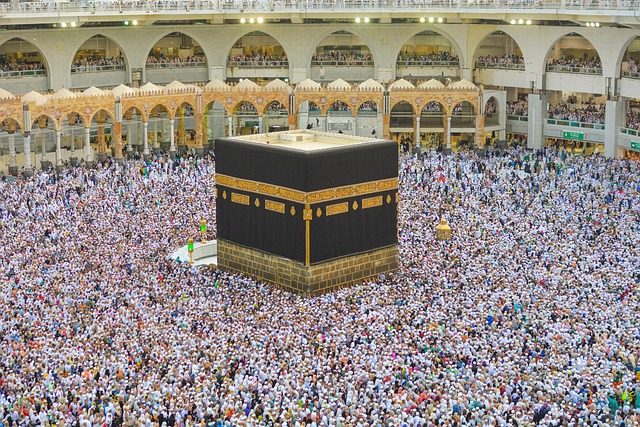

For those planning a pilgrimage to Umrah, through a reputable Umrah Travel Agency Bloomsbury, travel insurance is more than just a beneficial addition; it’s an indispensable part of your trip preparations. This is because Umrah trips often involve navigating unfamiliar territories, both literally and in terms of potential health risks. Travel insurance provides financial protection and peace of mind during these journeys.

Umrah is a significant religious experience that draws devotees from around the world, many of whom may travel to Saudi Arabia for the first time. This introduces various unknowns, from local healthcare systems and medical facilities’ quality to personal health vulnerabilities. A comprehensive travel insurance policy ensures that should any unforeseen medical emergency arise—be it an accident, illness, or a sudden change in health conditions—you’re covered for the necessary treatment and evacuation costs. This coverage is crucial, as medical expenses in Saudi Arabia can be substantial, and having insurance ensures you access quality healthcare without the added financial burden.

Deciphering the Different Types of Plans Available

When considering health insurance, one of the first steps is understanding the diverse range of plans on offer. These typically fall into two broad categories: managed care and indirectly purchased plans. Managed care involves partnerships between insurance providers and healthcare networks, where costs are often lower due to negotiated rates. This type of plan usually requires you to choose a primary care physician and receive referrals for specialist care.

In contrast, indirectly purchased plans offer more flexibility by allowing you to select your own healthcare providers. These plans may not be as cost-effective as managed care but provide the advantage of greater freedom in choosing medical services. For instance, an Umrah Travel Agency Bloomsbury client might prefer this option if they have specific medical needs or prefer to maintain their existing relationships with healthcare professionals outside of a network.

How to Choose the Right Coverage for Your Journey

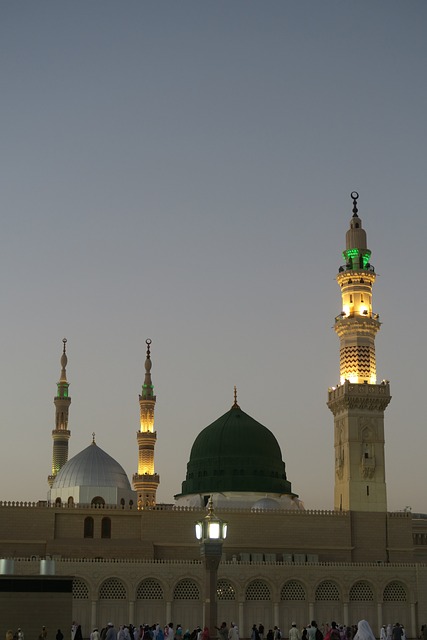

When planning a trip, especially a spiritual journey like Umrah with a Bloomsbury Travel Agency, choosing the right health insurance is paramount. You’ll want coverage that aligns with your destination and activities. Consider the length of your stay, pre-existing medical conditions (if any), and the types of medical facilities available in Saudi Arabia.

Umrah travel packages often include basic health insurance, but it’s crucial to review the policy details. Ensure the plan covers emergency medical evacuations, hospitalization, prescription drugs, and routine check-ups relevant to your health needs during the pilgrimage. Additionally, confirm if the insurance provider has a network of healthcare facilities in Saudi Arabia for seamless access to quality care throughout your journey.

Claims Process and What to Expect

When it comes to health insurance, understanding the claims process is crucial for a smooth and hassle-free experience, especially when planning a trip with a travel agency like Umrah Travel Agency Bloomsbury. The first step involves filing a claim with your insurance provider after receiving medical treatment. This typically requires submitting relevant documents such as receipts, prescription notes, and detailed records of services received. Many insurers offer digital platforms or mobile apps to streamline this process, allowing you to upload documents easily and track the status of your claim.

What to expect during this journey is clear communication from both the healthcare providers and your insurance company. You should receive regular updates on the progress of your claim and any necessary follow-up actions. It’s important to keep records of all interactions and retain copies of every document submitted to ensure a smooth claims resolution, ultimately providing peace of mind for travelers seeking medical attention during their trips.

Top Tips for Maximizing Your Health Insurance Benefits

When navigating health insurance, especially as a traveller planning an Umrah with a Bloomsbury Travel Agency, maximizing your benefits is key to ensuring peace of mind. Firstly, understand what’s covered under your policy. Read through your insurance documents thoroughly and familiarise yourself with exclusions, limitations, and any specific conditions related to travel. This knowledge will help you make informed decisions about your health while abroad.

Secondly, stay proactive in managing your health while travelling. Keep a record of all medical expenses, including receipts, for easy reimbursement. Regularly update your insurance provider if your travel plans change or if you encounter unexpected health issues. Additionally, consider purchasing travel medical insurance that complements your existing policy, offering enhanced coverage for specific activities or regions, like those encountered during an Umrah pilgrimage.

Planning an Umrah trip with Bloomsbury? Don’t embark on this spiritual journey without proper health insurance. Understanding your coverage, navigating claims processes, and maximising benefits are key to a hassle-free experience. By choosing the right plan and familiarising yourself with its intricacies, you can ensure peace of mind, allowing you to focus on the transformative power of Umrah. Remember, proactive preparation is the cornerstone of a successful and safe pilgrimage.